Skin care tricks to improve your being pregnant glow

Pregnancy is an exquisite and transformative journey for ladies, marked by numerous bodily and emotional adjustments. While anticipating moms concentrate on the well being and well-being of their unborn baby, it’s equally important to prioritize self-care throughout this particular time. If you might be on the lookout for methods to take care of your pores and skin’s well being whereas making certain the security of your rising child, we’re right here to assist! Check out some easy being pregnant skincare suggestions for a radiant and wholesome glow.

How to take care of pores and skin well being throughout being pregnant?

During being pregnant, hormonal fluctuations can set off numerous pores and skin considerations akin to zits, hyperpigmentation, elevated oiliness, dryness, or elevated sensitivity. However, with the best skincare routine, you may handle these pores and skin issues.

To preserve your pores and skin glowing throughout being pregnant, comply with these 3 steps:

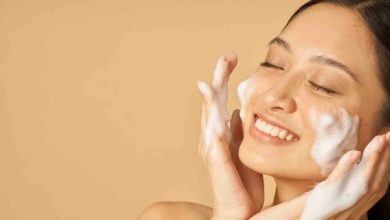

1. Cleansing: Choose a mild, soap-free cleanser that gained’t strip your pores and skin’s pure oils. Avoid merchandise containing retinoids, salicylic acid, and benzoyl peroxide, which aren’t advisable throughout being pregnant.

2. Moisturizing: Keep your pores and skin hydrated with a non-comedogenic, fragrance-free moisturizer. Ingredients akin to hyaluronic acid and ceramides may be useful.

3. Sun safety: Pregnancy could make the pores and skin extra delicate to the solar, resulting in hyperpigmentation or melasma, sometimes called the “masks of being pregnant.” To stop this, apply a broad-spectrum, pregnancy-safe sunscreen with at the very least SPF 30 day by day, even on cloudy days. Wear protecting clothes and keep away from extended solar publicity, particularly throughout peak hours.

Avoid these 3 issues to take care of a being pregnant pores and skin glow:

1. Cosmetic merchandise: Cosmetic merchandise will help improve your pure magnificence, but it surely’s important to decide on merchandise free from dangerous chemical substances that might probably be absorbed into your bloodstream.

2. Makeup: Look for pregnancy-safe make-up merchandise which can be free from parabens, phthalates, and synthetic fragrances. Mineral make-up is commonly a protected selection because it accommodates fewer irritants.

3. Hair care merchandise: Avoid hair dyes containing ammonia or different harsh chemical substances, particularly through the first trimester. Opt for plant-based or henna dyes as safer options. Regular hair remedies like keratin remedies and chemical straightening also needs to be prevented.

Common pregnancy-related pores and skin points and methods to sort out them:

Acne, stretch marks, and melasma (darkish patches on the pores and skin) are widespread pores and skin considerations throughout being pregnant. Although there isn’t a assured method to stop these adjustments, you may handle these with easy suggestions.

1. Acne: Pregnancy hormones can set off zits breakouts in some ladies. When coping with pregnancy-related zits, keep away from utilizing harsh zits remedies or prescription drugs. Instead, incorporate mild, pregnancy-safe merchandise containing components like tea tree oil or witch hazel to assist handle gentle breakouts.

2. Stretch marks: Stretch marks are a standard concern throughout being pregnant, ensuing from the pores and skin’s fast stretching. While it might be difficult to stop them completely, common moisturization will help enhance the pores and skin’s elasticity and cut back the severity of stretch marks. Look for lotions or oils with components like cocoa butter, shea butter, almond oil, and vitamin E.

3. Melasma: Protect your pores and skin from the solar, as publicity can worsen melasma. In addition to the sunscreen recommended, use a wide-brimmed hat and search shade when outdoor.

Tips to guard your hair and nails throughout being pregnant

Hair and nails can bear adjustments throughout being pregnant, akin to elevated hair progress and brittleness. Maintaining wholesome hair and nails entails easy practices:

1. Hair care: Use a gentle, sulfate-free shampoo and conditioner. Regularly trim your hair to maintain it trying neat and wholesome.

2. Nail care: Keep your nails trimmed and moisturized to stop breakage. Opt for pregnancy-safe nail polishes with out dangerous chemical substances.

Taking care of your magnificence throughout being pregnant is a fragile stability between self-care and making certain the security of each you and your child. Consulting a dermatologist and cosmetologist can present higher steerage and product suggestions in accordance with your wants. Remember to embrace your pure glow and prioritize a wholesome life-style throughout this time.